The Art & Auctions Market: A Look Back at 2021. A Look Ahead to 2022

In this Hookson blog, we’ll take a look at the highlights that defined the global art market across 2021. Then we’ll offer a range of art market 2022 predictions. Just what might the coming year bring to this creative, fascinating – and unstoppable – sector?

Extraordinary Circumstances Created Smart Solutions

The art, auction and collectibles market, like every other sector and industry on the planet, has been negotiating the changes imposed by Covid.

The pandemic has ushered-in smart digital solutions like virtual exhibitions and online auctions. And here at Hookson we’ve been supporting our art sector and auction house clients in riding out these extraordinary circumstances.

Across the last eighteen months or so their resilience and creativity has been impressive, with levels of service maintained as high as ever.

Familiarity and Escape

Perhaps it’s not so surprising. After all, in times of adversity, art – and the desire to get closer to it – grows in importance, supplying comfort and, in equal doses both familiarity and escape.

Whilst it’s true that the pandemic urged artists, auction houses and galleries to do things differently, it was never going to stop them doing things brilliantly.

The Art & Auction Markets 2021 – the Lowdown on the Highlights

As we’ve touched upon. with Covid came the necessity – and the opportunity – for the global art & auction markets to reappraise themselves.

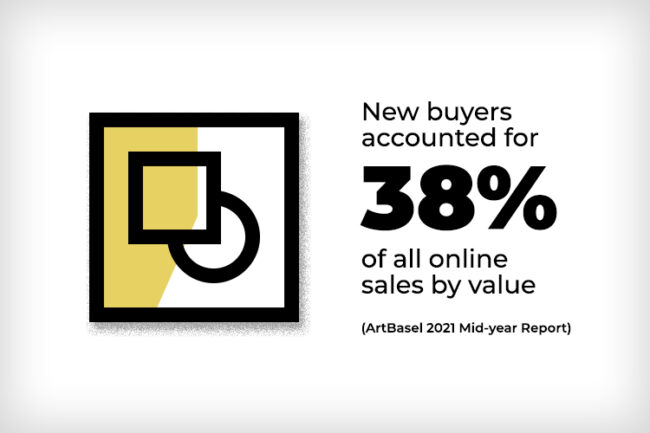

The virus infected every major component of the business of buying and selling art. Established, unchallenged-for-decades ways of operating – particularly across in-person events like fairs and auctions – were forcibly pulled further into the digital world. Suddenly virtual exhibitions took precedence, as did online-first bidding and buying.

Alongside fundamental issues like employment and what to collect, issues of sustainability dovetailed with the shift to digital solutions. And, staying with digital, we must make mention of a curious new disruptor that really came of age in 2021: the Non Fungible Token (NFT).

Would the punky NFT be a peacocking flash-in-the-pan? Or a serious here-to-stay challenger?

2021 would provide an indication and – clue – would see even the most traditional auction house hammers confirming sales in the tens of millions.